The Carbon Border Adjustment Mechanism

Home The Carbon Border Adjustment Mechanism

As a central component to the European Green Deal framework for reducing net greenhouse gas emissions by at least 55% by 2030 and achieving climate neutrality by 2050, the CBAM is one of the tools the EU is implementing to monitor and ultimately reduce the negative environmental impacts of goods sold into the EU.

Fostering sustainable investments

To make it simple, the CBAM is not focusing on the tons entering into the EU market but on the quality of their manufacture, expressed in the tons of carbon dioxide their supply chain emits and sends to Europe. Those imported emissions will therefore end up having a price reflecting their CO2 footprint.

European industry has been subject to this obligation since 2005, when the pilot of the EU Emissions Trading System (ETS) was first launched. The CBAM is the counterpart of the ETS, applied to foreign goods. As such, the sectors involved are iron and steel, cement, aluminum, fertilizers, electricity, which mirror the EU ETS’ makeup and adds hydrogen, which is very much in need of investments.

Therefore, the CBAM aims to embark and foster the decarbonization of the key sectors abroad that are driving the most climate negative effects by conditioning EU market access to sustainable practices. Those exporters interested in reaching the Common Market would likely prop up investments in common sustainable operations. Importers, on the other hand, will be asked, as any other company operating in the EU, to monitor, report and improve their supply chain in terms of CO2 footprint.

Keeping European industry in Europe

By ensuring carbon price equity between domestic and imported goods, the Commission intends also to prevent EU industries from relocating to less environmentally compliant regions by establishing a level-playing field. The EU businesses who have invested for decades in their own costly decarbonization will not be subject to an unfair competition from polluting producers not applying an equivalent CO2 pricing system.

As far as exporting into the EU is relevant for an exporter, the market conditions established by the CBAM must certainly be weighed when thinking about relocating. Again, sustainable operations are the standpoint.

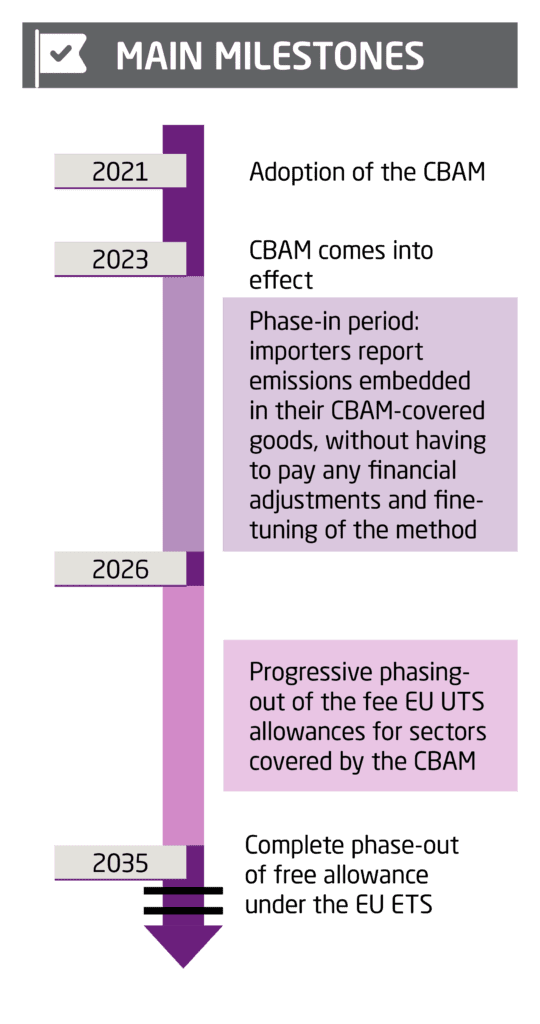

Implementation milestones

Taking into account the novelty and complexity of the CBAM, a 2-year transition period will take place from October 2023 to the end of 2025. This is meant to give all private and public partners, EU based or not, time to understand what CBAM means for their European business model and to adapt accordingly.

As stated by the Commission, during the transition period, “the importers of goods in the scope will have to:

- report greenhouse gas emissions (GHG) embedded in their imports (direct and indirect emissions),

- surrender the corresponding number of CBAM certificates,

- without making any financial payments or adjustments.”

Furthermore, “the gradual phasing in of CBAM over time will allow for a careful, predictable and proportionate transition for EU and non-EU businesses, as well as for public authorities”.

Thus, a refined CBAM following the transition period (January 2026) will materialize as such:

- The price of the certificates will be calculated depending on the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted.

- The phasing-out of free allocation under the EU ETS will take place in parallel with the phasing-in of CBAM in the period 2026-2034.

To wrap-up

To comply with climate objectives, the EU aims to further boost the energy transition both domestically and abroad. From these perspectives, it can be the much needed game changer as customers will be incentivized to source their material from the lowest CO2 producers. The CBAM is indeed a global climate tool based on CO2 /t per product, meaning it can effectively fight climate disruptions by encouraging investments in sustainable operations as the ETS has long been successful in doing in the EU.

The CBAM is seen as a learning process that is meant to bring all partners, importers, exporters and public authorities together during the two year transition period to find agreement on the efforts we all collectively need to engage in now.

Deep-diving in the details of its own supply chain, as heavy as this review can be, will be a preparation work for other tools to arise within the second half of the decade as the Digital Product Passport, the digital twin reporting all the KPIs related to a good’s life cycle, from mining to end-of-life management.

The next round of details is expected to be released this autumn. We, at Aperam, are following this changing world and will be happy to share with you how we can together improve the resilience and the sustainability of our industries. Reassessing operations in the light of climate objectives is now our common duty. Stay tuned!

The CBAM reporting process

- The producer from a non-EU country provides emissions data for the importer’s declaration.

- The EU importer registers with its national authorities. This authority allows registration of registrants in the CBAM system, reviews the verification of declarations and sells CBAM certificates to importers.

- The EU importer must declare its imported emissions (direct and indirect) to the national authority and then return the corresponding CBAM certificates to the national authorities. In the event that the producer does not provide the necessary information for the declaration, standard data may be used.

- A third-party verifier provides a reasonable assurance report on total imported emissions.

Sources:

- https://www.insee.fr/en/statistiques/6478761: One third of the European Union’s carbon footprint is due to its imports

- https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en#latest-developments

- https://carbonmarketwatch.org/2023/03/06/transforming-the-eus-industrial-pollution-policy-into-an-effective-climate-tool/

- https://www.siemens.com/global/en/company/topic-areas/product-carbon-footprint.html?gclid=CjwKCAjwjYKjBhB5EiwAiFdSfvNDo4FwBOatmrfi0YJ_PPIyV495TiWyumJAl_b3h_fsvmUoJZzxPxoCR80QAvD_BwE&acz=1

- https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/energy-transition/050923-chinas-compliance-emission-trading-system-to-accelerate-coverage-of-cbam-eligible-sectorshttps://www.oecd.org/sd-roundtable/papersandpublications/RTSD41%20background%20note_FINAL.pdf

1,32%

1,32%