Energy: What next in 2023?

Home Energy: what next in 2023?

The price of gas in Europe began its upward trajectory in the fall of 2020 following the first lockdown. But prices really skyrocketed in 2021, with an average increase of +397% versus the previous year. Various issues hampering supply from Norway and Russia, then the largest supplier of natural gas to the European Union (EU), were accountable for the runaway.

In 2022, following Russia’s war of aggression against Ukraine, European gas prices jumped again several times during the course of the year, most notably in August when Russian gas deliveries to Europe via the Nord Stream gas pipeline were cut.

The REPowerEU plan, which was released in May 2022 with the aim of shifting supply away from Russia, helped to cool off the price, which stabilized in January 2023 at 2021’s recovery levels – still 25% above the 2020 average.

According to the International Energy Agency (IEA), the European Union has made “impressive progress” in reducing its reliance on Russian gas supplies. The EU has built and secured capacities by enhancing its portfolio of Oil & Gas (O&G) producers and further deepening diplomatic ties with key supplying countries. Liquified Natural Gas (LNG) deliveries were secured by new routes coming from such countries as Qatar, Egypt, and Algeria. The United States alone accounted for around 50% of the EU’s total imports in the second semester of 2022, more than doubling the volume exported from the US to the EU year-on-year.

New gas infrastructure projects have also became operational since the outbreak of the war:

- The gas interconnector between Greece and Bulgaria

- The Polish-Slovak gas interconnector

- The Baltic pipe, delivering gas from Norway

- A new floating LNG terminal in Eemshaven, the Netherlands

Governments’ strategic inventories, the energy savings, new operational capacities and diversified supplier portfolio did indeed succeed in mitigating market energy supply risks in 2022. So did the macroeconomic context, with behavior’s evolution and a drop in global demand being the main drivers:

- Shortages, price hikes, high banking rates, and the increasing cost of capital all muted demand

- Projects were put on hold, with investors needing better clarity in regards to the choice and roll-out of climate technologies

- A mild 2022 winter

- China’s lockdown

All these factors have helped halve the shortages and prices during this period. Yet, despite the poor global macro conditions of 2022, output took the helm. For example, crude steel production remained in a high side trend, with a production of 1,879 million metric tons, -4.2% versus 2021, but still above 2019’s decent levels. But what about the 2023 consensus ?

Demand

The IEA’s short-term oil market report of February 2023 predicts that worldwide demand will climb to almost 101.9 million barrels a day by the end of 2023 (+2% versus 2022) and rise to 2.83 billion cubic meters per day in 2023 and 2.88 bcm/d in 2024 in natural gas, from a record of 2.77bcm/d in 2022, 2.2% and 4% growth respectively (per the IEA January press release).

China is set to gradually reopen its economy, accountable for ¼ of worldwide growth, dragging up the demand in its commercial routes. Several pledges have been also made for sustainable technologies worldwide such as the US that have announced their own Green plan through the Inflation Reduction Act and the Green Deal that is starting to process after years of R&D and ongoing normative writing. The estimated EU base demand scenario is at 395 bcm of natural gas for 2023 (396.6 bcm in 2021) for now.

In regards to demand in goods, if we look at the economy in terms of real need for decarbonation instead of focusing on contextual real demand, a full world is yet to be built and equipped. The need for clean energy, clean mobility, clean industries, clean heating systems and sustainable housing, the need to develop circular economies and proper connectivity, well, the need to build a global sustainable framework is huge. Thus, so is the underlying demand. Therefore, 2023 has still a window for growth despite the economic general consensus heading to a recession, especially in the EU.

Supply

On the supply side, Russia delivered around 60 bcm of natural gas to the EU in 2022. A full cessation of Russian gas supplies to the European Union, combined with a return of Chinese LNG imports to 2021 levels following its reopening, would lead to a shortfall of 27 bcm of gas in Europe during the summer of 2023. According to the IEA, this is equivalent to 6.5% of total EU consumption, or around 50% of the gas storage refillment needed to reach 95% of capacity by the start of the 2023-24 heating season. European storage capacities were at 65% as of mid-February, down from 90% in November 2022, and set to fall to around 50% by the end of winter.

As the EU works to diversify sources, it will add an estimated 40 bcm of LNG import capacity by the end of 2023. The Middle East & Africa’s new capacities and China’s expanded quotas for O&G product exports established in late 2022 are further paths to secure EU supply.

In early 2023, the OPEC+ still remains in a wait & see attitude since their moves of cutting production in November 2022, reviewing conditions every two months and looking at key indicators of market shifting variables. The O&G market is experiencing disruption as never seen before, in terms of rerouting and market cycle within a shifting technological and geopolitical context. Market wise strategy is yet to be seen when China will recover.

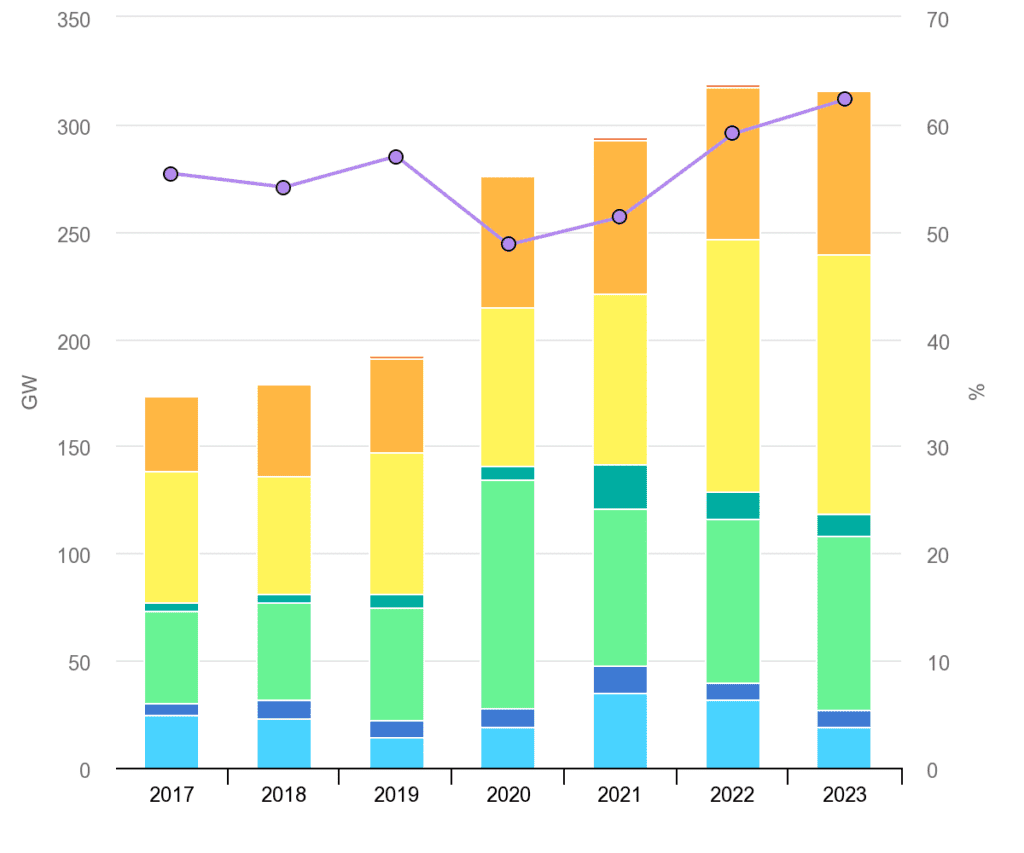

Moreover, the production of clean energy and storage alternatives capable of offsetting, at a point, the dependency on fossil fuel, is one possible means. The world now has 295 gigawatts of green generating capacity, says the IEA, an “unprecedented acceleration” as described by the World Economic Forum. As for China, the country added 1,190 terawatt-hours (TWh) of wind and solar power output (+21%) in 2022, nearly equaling Chinese housing demand for electricity as reported by Bloomberg based on the Chinese National Energy Administration. Some additional O&G availability but also Renewable Energy could therefore be available in the market.

Regardless of how the Energy Transition transpires, Aperam is already preparing – and transforming – itself and its operations. Through our energy roadmap, we are reducing the amount of energy we consume, increasing the energy efficiency of our process, recovering (and reusing) the heat we regenerate and increasing our use of renewable energy (windmills in Genk, photovoltaic panels in Châtelet, Genk and Isbergues).

We, at Aperam, will follow the Energy Transition as it continues to unfold. Stay tuned!

Sources:

- https://iea.blob.core.windows.net/assets/96ce64c5-1061-4e0c-998d-fd679990653b/HowtoAvoidGasShortagesintheEuropeanUnionin2023.pdf

- https://www.iea.org/reports/never-too-early-to-prepare-for-next-winter

- https://www.iea.org/data-and-statistics/charts/net-renewable-capacity-additions-by-technology-2017-2023

- https://www.iea.org/reports/oil-market-report-february-2023

- https://www.bloomberg.com/opinion/articles/2022-12-14/peak-oil-demand-is-nowhere-in-sight?leadSource=uverify%20wall

- https://www.energypolicy.columbia.edu/oil-markets-and-opec-in-2023/

- https://yearbook.enerdata.net/natural-gas/world-natural-gas-production-statistics.html

- https://www.weforum.org/agenda/2022/06/state-of-renewable-energy-2022/

- https://www.consilium.europa.eu/en/infographics/eu-gas-supply/

- https://ceenergynews.com/lng/europes-lng-import-capacity-set-to-expand-by-one-third-by-end-of-2024/

- https://oilprice.com/Latest-Energy-News/World-News/Chinese-Wind-And-Solar-Output-Is-Nearly-Equal-To-Household-Demand.html

- https://worldsteel.org/steel-topics/statistics/steel-data-viewer/

2,23%

2,23%