Inflation: What it is and why it’s happening

Home Inflation: What it is and why it’s happening?

The global inflation wave is reaching new highs. Even Europe, which is usually quite stable in this matter, finds itself in the middle of the storm, with the Eurostat Eurozone inflation rate at 7.5% in April. Across the Continent, rates tend to vary at 8.3% in Spain, 7.8% in Germany, 6.6% in Italy and 5.4% in France.

Although inflation can be sectoral and specific, today, it takes a lateral form as it impacts the entire economy, from households to businesses to government. Furthermore, it’s happening at the global level, leading to a currency depreciation, interest rates increases, decreases in exports and purchasing power. it could lead to an austerity behavior by economic agents such as the postponement or holding of investments.

To better understand the phenomenon, let’s take a look at the usual suspects behind inflation:

- The most common one, explained by Keynes, is an imbalance between supply and demand. When demand exceeds supply, prices automatically increase. It is therefore the scarcity of the good that drives the increase in price.

To illustrate, consider how the post-COVID recovery led to soaring ‘catching-up’ and surging demand for new businesses. This happened while global production capacity was not fully operational (even today this capacity has yet to catch up to demand). In addition, the demand for Climate technology is tackling some materials such as semiconductors or rare earth from under capacity industries and is generating new bottlenecks, exacerbated by the war, hampering even more key material deliveries. As of today, 2/3 of industry and half of the building and construction sector are reporting material shortages in the US, when the US just started its Green Biden plan. These shortages, combined with freight and energy issues caused by multiple factors such a lack of investments, COVID-related lockdowns, and the war, are driving the inflation peaks.Due to this global imbalance, prices began increasing as early as the first quarter of 2021. Even when the operating situation becomes normal, demand will continue to mount due to climate transition needs, consumers’ confidence return, backlog of work and the paucity of some related input.

- Inflation due to costs, also known as cost-push inflation, reflects a generalized and persistent rise in input prices across the value chain that triggers an increase in the cost of manufacturing. This in turn provokes a decrease in the aggregate supply and a lowering of demand that is unable to cope with high pricing pressure.

The increase in operation costs comes either from fixed costs such as wages or capital or either from the pricing variation of the inputs such as the raw materials or energy necessary for output.

To illustrate, OPEC, which controls the majority of the world’s oil reserves, is highly influential in O&G pricing, which it determines through the consensus of production levels among members. Since COVID and the outbreak of war in Ukraine, OPEC members have been sticking to a certain output of barrels per day, maintaining a price of around $100 per barrel. On the contrary, Russia, which is affected by an EU ban on oil imports and an ongoing Chinese lockdown, is facing a demand issue and is therefore selling its output to India below $70 per unit. This pricing would evolve when China will be back on track or with the winter season. The cost-push inflation is also fed by the Keynesian approach.The cost-push inflation mechanism is indeed pushing all prices up nowadays: first the raw materials and energy, then the intermediary goods, the logistic costs, and the “pass-through” to final prices.

- Monetary originated inflation implies an excessive increase in money supply, which causes the currency to lose value and interest to fall. Prices then rise to compensate for the depreciation.

Quantitative easing and low rates have gradually become the new normal since 2015. Take for example the rise in real estate selling prices, which is typically correlated with the rising amount of loans, helped by low banking rates. Together, this boosted demand and thus boosted prices.

The BCE has started to prepare the market for a tightening monetary policy cycle starting in July 2022 and an increase in the central interest rate when inflation stabilizes at around 2%. The UK or the US have already paved the way. This will help drive prices down by tightening demand. But strong demand related to Climate needs will still be a fact, and capacity will need to be adjusted through investments, thus driving higher capital cost.

- Structural inflation is connected to some structural changes within the economy that promote inflation. An example is a monopoly situation characterized by an absence of competition.

The incoming supply-side economy spurred by the climate transition and supported by Public Private Partnerships, implying a firm and vital demand and partially financed by public funds, is another example of structural inflation rise. In this case, the certainty of the incoming financed demand plays the role of the monopoly, so prices could move higher even in a competitive bidding environment.

- Speculative inflation is the consequence of a forecast. A negative forecast will cause a producer to increase the price of commodities to compensate for potential future losses. This behavior partially explains the observed inflation on food. Indeed, the Ukraine war looks to be leading to a food crisis by the end of the year. Ukraine, the number one exporter of sunflower oil, 4th for corn, barley and sorghum and 5th for wheat, will be unable to commit to the total demand it usually delivers, and Russia will be under sanctions from a part of the world. The scarcity will most likely materialize during the harvest season this autumn, but prices are already higher today to help offset the losses of 2023.

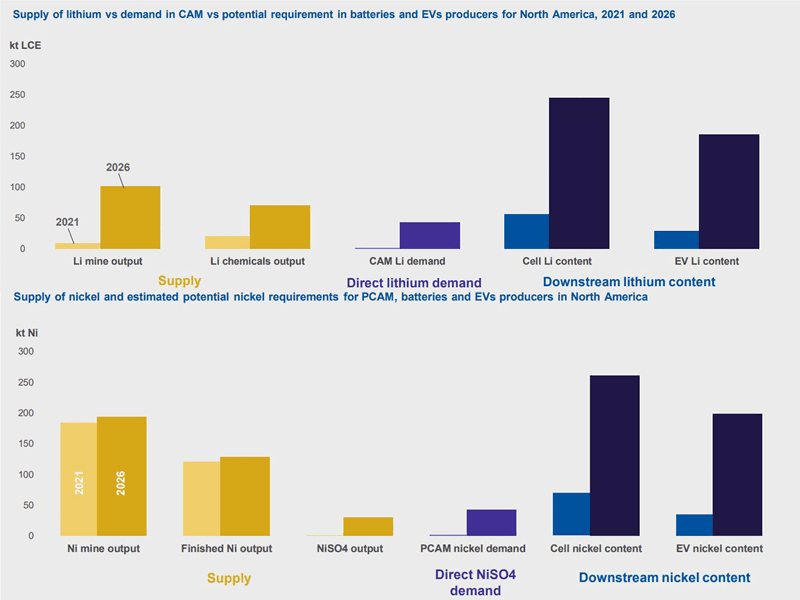

From a positive forecast standpoint, EV battery input like lithium and nickel, is painting the picture. Demand is set to far surpass supply availability. Investments are needed to enable these capacities. Demand is ramping up. Prices, amid other causes, are staging at high ranges. But in four years, innovation and choice of technologies could change and mining operations could be optimized, leading to a drop in pricing.

Even if the inflation is speculative, the effects are real for down-streamers and weigh on the purchaser’s bill.

Source : CRU

In Summary

To sum-up, cyclical inflation is fluctuating due to the timely concordance of the five reasons mentioned above, creating a perfect storm to make the market durably volatile. Speculative bubbles, incoming sustained demand amid a transition to climate related technology that requires the supply of massive amounts of raw materials, lasting shortages, COVID management, the ongoing war, and tightening at the central banks all support pricing volatility.

Daily pluses and minuses are weighing on business sentiment too, driving short term demand unpredictability. This means the whole market is behaving like the stock market, reacting to any information related to the current situation with a stop-and-go attitude.

The transition to a sustainable world is and will drive demand up across a large scope of industrial sectors. The continuous increase in the prices of goods and services for several consecutive semesters could disrupt the recovery. Markets will adjust, supported by Public policies, but dialogue across the supply chain is key to trying to navigate through this inflation and reach a good level of prices for all agents.

Aperam is committed to dialogue, which we believe is the best way to maintain the robust level of work needed to achieve our common ESG goals.

2,23%

2,23%