Is European Industry a Thing of the Past?

Home Is European Industry a Thing of the Past?

While thousands of projects are being processed in Europe and represent strong commercial potential for Aperam's customers, the situation remains gloomy. Why this paradox? Cristina Marques gives some clues to understand the picture.

Transitioning

The portfolio of work being concretely processed is increasing tremendously and reaching new heights.

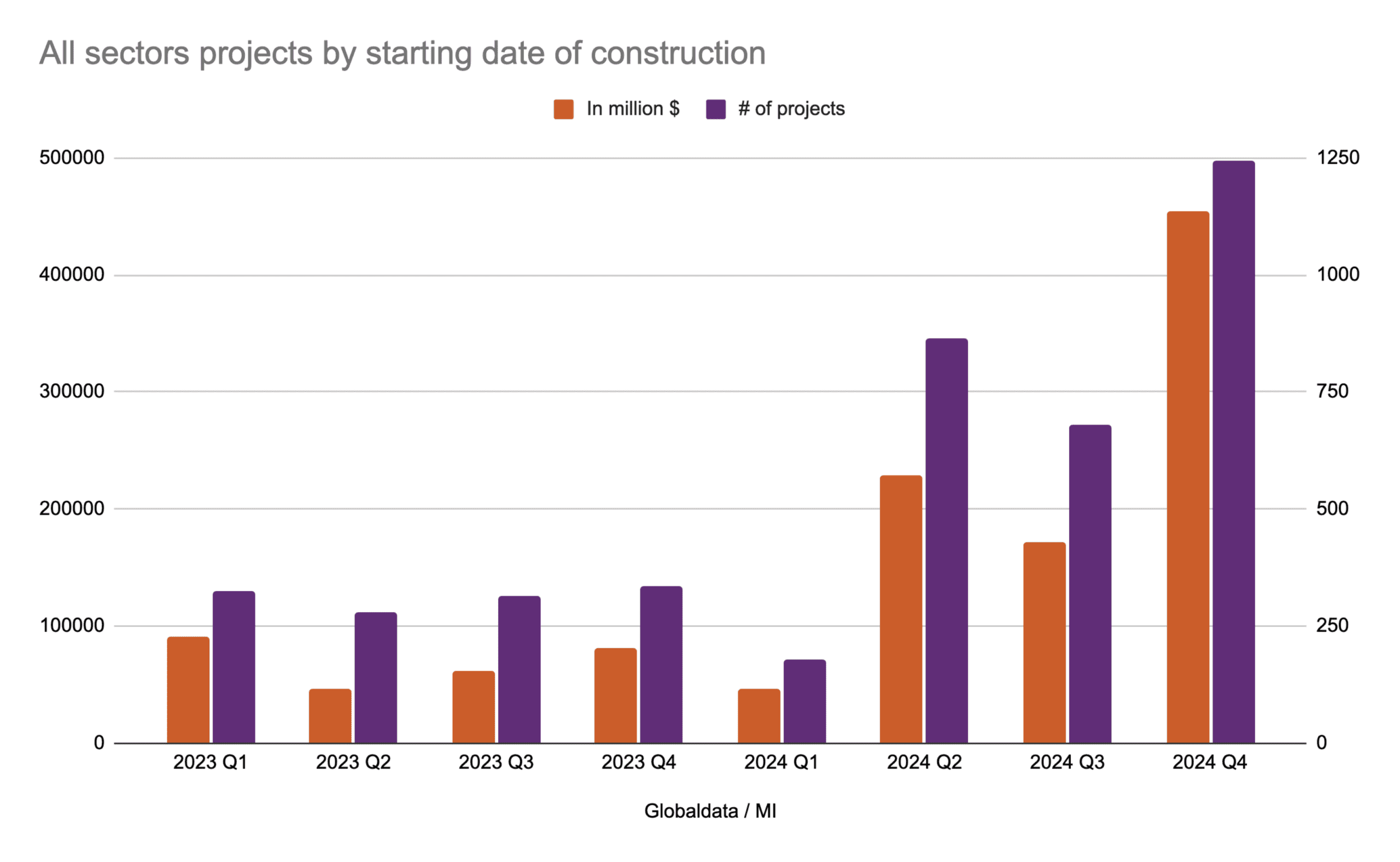

As per Globaldata, the EU27 alone shows a portfolio nearing the 3000 projects, all sectors included, scheduled to start construction in 2024 for a total amount of about USD $900 billion to be spread across the building period. This means an increase of 223% in value and 137% in number of active projects versus 2023.

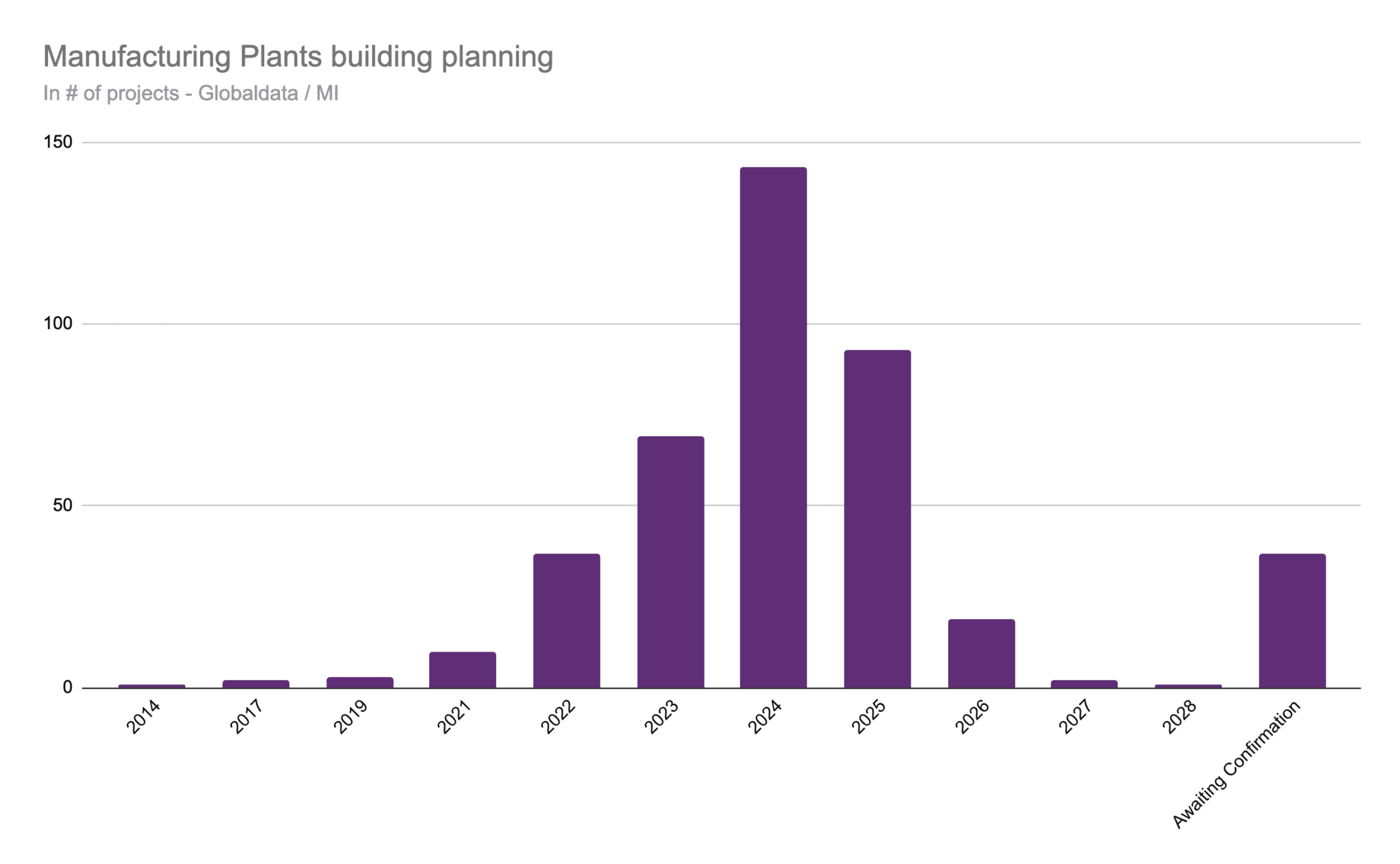

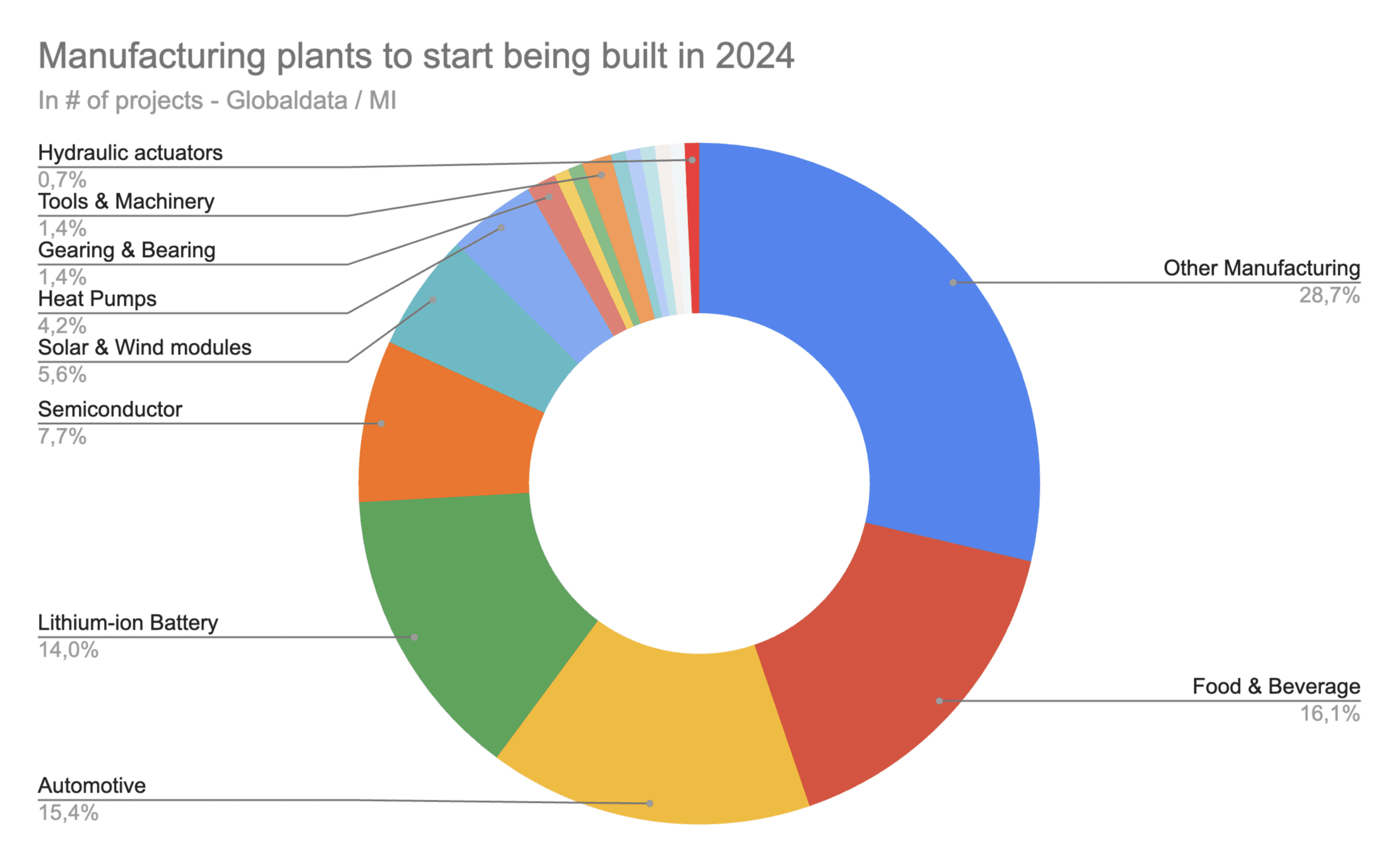

Among these projects, manufacturing plants represent 4.8% of total construction for the year with around 140 projects planned, and 4% of the total active portfolio, including some 400 new factories to be built in the EU within the coming years. This means that more than a 1/3 of the factories either announced or being studied should start construction in 2024.

Fundamental hurdles remain as known from 2023…

Will we see all this work happen this year as we are already well into spring? Probably not. No sector is on schedule, not even close. 90% of 2024 construction planning was still at the engineering stage at the end of April. Postponements are commonplace, explaining the exponential amount of work delayed from 2023 to 2024 and beyond.

Reindustrialisation and equipment are officially on their way, but slower than forecasted as the following questions remain:

- Unfortunately, global instability still prevails. From a business point of view, this could further hamper the stability of O&G supply, prices and transportation costs.

- In Europe, the high cost of production, high rates of loans, high capital prices, along with technological choices, legislative compounds, heavy bureaucracy, and the wide range of new knowledge to acquire at the staffing and engineering levels are all still slowing the journey towards a healthy recovery in the EU.

- Assessments for foreign market investments are ongoing. The Asian market and the US IRA (Inflation Reduction Act) fiscal conditions are still very engaging, both in terms of demand size and the economic fundamentals: costs of production, closer access to raw material, better financing and fiscal conditions, lighter bureaucracy, increasing business openness, and direct to market partially offsetting freight issues not to mentioned the new key indicator to follow which is the access to green energy that could become available to industry in China sooner than foreseen.

- Adding foreign investments rather than delocalizing European assets is nonetheless a non-negligible scenario. The main hurdles to FDIs (Foreign Direct Investment) still lie in the stability and predictability of the applicable law in a changing world. Nevertheless, sufficient access to green energy for production is key, especially if the targeted market of foreign output is the EU Single Market. The CBAM (Carbon Border Adjustment Mechanism) is being implemented.

Short term outlook

But not everything is about international business. Climate-led infrastructures and the industrial capacities to build them are needed in Europe too. So, let’s presume that only a quarter of the above investments goes from the engineering office to the shovel. By the end of Q2-24, we might have a better outlook than Q1 already. An acceleration could even be seen in the second semester, especially if more than a quarter of the forecasted book goes to execution.

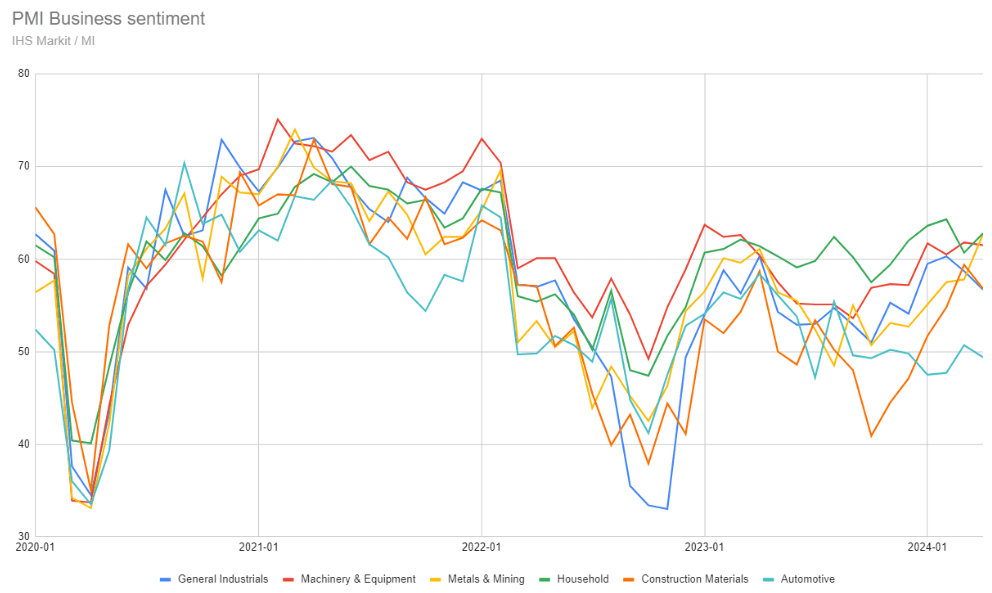

Going live or not, this load of projects being concretely announced, engineered or starting construction, explains by itself the business optimism index followed by IHS Markit that keeps expanding despite a laborious context since 2020.

Two key supply chain systemic sectors have gone to new lows in 2023, partially weighing on growth. Here again, clearings are in sight.

Construction

One of those sectors is construction, which is responsible for 9% of EU GDP, 18 million direct jobs, and approximately 36% of all CO2 emissions* in the European Union. 50% of the EU’s final energy consumption is used for heating and cooling, of which 80% is used in buildings. The potential for decarbonizing this sector is therefore impressive.

To do so, the profession has been processing a drastic U-turn since the Green Deal was announced in December 2019. It is reviewing its portfolio through the lens of the New Building and Bauhaus deal.

Supported by the new market opportunities required by the climate infrastructural needs, the sector is diversifying from the office, leisure, commercial and residential buildings that drove the sector for decades towards sustainable building and renovation.

Moreover, the sector is becoming an important ESG enabler, propelling other manufacturers to emerge, such as solar or heat pump factories. To illustrate, 10 heat pump factories are on their way to being constructed in the EU27. Seven of them are starting construction in 2024 and three will start to deliver during the course of this year, becoming themselves new suppliers and customers.

Automotive

For its part, the automotive sector, responsible for 11.5% of EU manufacturing jobs, contributing up to 7% of EU GDP, and 19% ** of total EU emissions C02 for cars (16%) and vans (3%), started transforming years ago, well before the Green Deal announcement. But the journey is far from being over, both on the customer and producer sides.

The sector that is set to deliver a Digital Passport Product for its Battery segment in 2026 is still negotiating the legislative framework and the pricing level of any parts while reviewing its supply chain, assessing the availability of raw material routes, sorting out the diversity of technologies, improving and deploying the ecosystem such as chargers needed to sell any EV, developing alternative fueling and motorisation to ease and diversify the transition, implementing a new product design network to create efficiency, working hand in hand with the energy sector to set out a coherent roll-out. All this in a world where the customer is yet to be convinced and professionals are still being trained on new technologies.

Nevertheless, 10 new automotive component and assembly plants are set to become operational in 2024 in Belgium, Bulgaria, Czechia, Germany, Hungary, Italy, Poland, Portugal and Sweden. Six lithium battery plants will also launch production in France, Germany, Poland and Sweden this very same year.

Hurdles are numerous but not unconquerable. Both sectors’ business sentiment again started to expand in late 2023.

While the recovery in the construction sector is crystal clear, automotive is still building its way within the numerous promising technologies and the clever and necessary trade off to reach in many subjects, such as the ongoing normative and technological ones.

All other sectors

All other sectors have remained optimistic, noticeably falling into contraction only once since the full stop of 2020. The fall was then due to the wild reorganization and inflation wave occurring in the second half of 2022, both direct consequences of Russia’s invasion of Ukraine.

Since then, a stimulating number of projects, all potential stainless steel users, are planned to be constructed in all sectors. The Energy and the Infrastructure sectors ones are well ahead in terms of investments load.

The Industrial sector is also showing a full range of new capacities being added to tackle the Climate challenge. To illustrate, 2 additional electrolyser manufacturers are starting production, one to be opened in 2024 in Spain, another one will be finalized in 2025 in Germany. 16 solar and wind modules manufacturing all around Europe are in the pipeline too. 3 factories are already in construction as hundreds of solar and wind farms are being processed but also energy storage projects and the infrastructure to support such a regional coverage. Even the well followed flying boat plant is set to cut its red ribbon and eventually start production in 2024, becoming both in turn supplier and customer.

Some other good news is emerging!

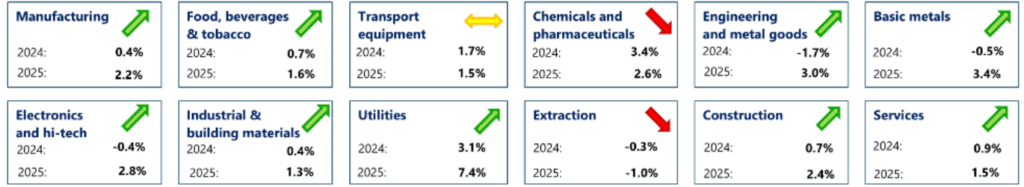

Oxford Economics forecasts industrial production growth of 0.7% in 2024, peaking at 2.8% in 2025, helped by falling inflation, which could gradually support household demand, according to their analysis. Forecast as of March 2024.

Big players are entering the ESG financing scheme both more massively and publicly. The multiplication of partnership announcements, including by some major players, is providing a sense of visibility, clarifying technological pathways and driving financial solutions.

Moreover, following the European elections in June 2024, the EU will review the basics and details of the Single Market to develop a blueprint for the EU trade framework in order to reduce bureaucracy as a start and therefore facilitate market readiness and access.

Last but not the least, fiscality and sustainable finance will eventually provide a compass for effective sustainable deployment in the EU, providing some relief to existing industries:

- The Next Generation EU Fund is spurring investments to construction and power sectors.

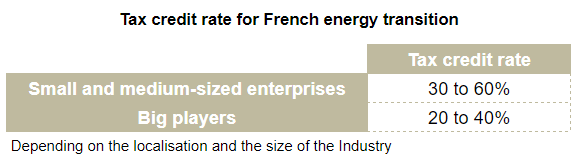

- Local fiscal schemes are being implemented in places like France, where tax credits are now available for the batteries, wind power, solar panels and heat pumps sectors.

To wrap-up and go further

It seems indeed very awkward to say that there is no fear in relation to future businesses while we are all experiencing a great stagnation. But the engineering figures say that there is nothing to fear in terms of workload in the near future, even if the effectiveness of the projects’ work is to be monitored.

Climate wealth has everything to do with industrial wealth, which is all about market needs, readiness and access indeed. A clear and willingful EU Industrial Deal will certainly deepen the observed reindustrialisation path and deployment of infrastructure.

The true obstacles for now are obviously linked to the unspeakable international situation, the ongoing normative writing and bureaucracy, all partially tied now to the EU election of June 2024, access to funding, but also, and in particular for the industry nowadays, to production costs’ levels.

It will be mandatory to strive to find fair input and output prices adapted to regional needs and conditions, allowing all parties to keep producing and deploying while trying to avoid a new wave of disastrous inflation in case of a looming recovery or other production drops tied to a prolonged stagnation. In short, it is simply about allowing the economy as a whole to make a sustainable living.

But as the EU president says, the Green Deal is a “man on the moon” moment. Dream, dream… dreams can become real.

We, at Aperam, are passionate about this journey to the moon and will share with you all the valuable information to get there together. Stay tuned!

* https://eur-lex.europa.eu/legal-content/FR/TXT/HTML/?uri=OJ:L_202401275

** https://climate.ec.europa.eu/eu-action/transport/road-transport-reducing-co2-emissions-vehicles/co2-emission-performance-standards-cars-and-vans_en

- https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52016DC0051&from=EN

- https://www.entreprises.gouv.fr/fr/credit-impot-industrie-verte-C3IV-agrement

- https://www.entreprises.gouv.fr/fr/industrie-verte-et-decarbonation/credit-d-impot-pour-l-industrie-verte-c3iv-foire-aux-questions

- https://www.acea.auto/fact/facts-about-the-automobile-industry/#:~:text=The%20turnover%20generated%20by%20the,of%20the%20EU’s%20total%20GDP.

- https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52016DC0051&from=EN

- https://www.daikinafrica.com/fr_fr/knowledge-center/the-green-deal.html

- https://www.china-briefing.com/news/china-announces-industrial-equipment-upgrading-action-plan/

-2,63%

-2,63%