Walking the Talk

Home Walking the Talk

Two years after the launch of the Green Deal, the EU is still busy reviewing many of its multiple initiatives, with the aim of codifying them by the end of 2023. Nonetheless due to the international situation, this transition has become increasingly important.

Meanwhile, at the start of 2022, the industrial world has already stepped up, starting to design and implement many of the innovation and development projects needed to reach the Green Deal’s objectives. In fact, globally, across the industry, energy, and infrastructure sectors, there are more than 31,000 active projects either announced, under review or in the execution phases.

The European continent is home to 19.5% of these, with more than 6,000 active projects, for a total amount of USD 4430 billion (as of today, early 2022). This portfolio is broken down along the following lines:

- More than 100 projects are announced for a declared value nearing USD 65 billion

- Almost 2000 are currently being built, for about USD 1.600 billion

- Around 3900 are under review, in the process of being awarded, and are covered by an intentional spending closed to USD 2700 billion

Many other projects are in the works and are awaiting for their timelines to be confirmed, but let’s focus on the ones already in the inventory.

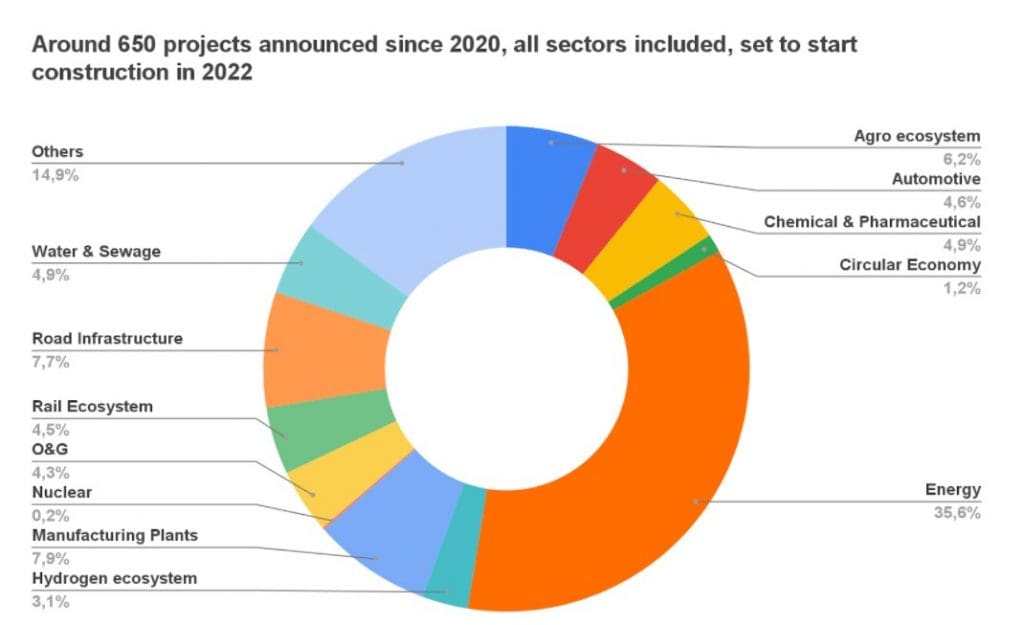

This includes the more than 1400 projects nearing USD 495 billion that have been announced since 2020, demonstrating the concrete implication of the industry. Around 67% of the overall portfolio is yet to be engaged. 32.2% are set to start construction, so set to be an effective investment in 2022, with 19.1% to follow in 2023, for a total amount of USD 888 and 943 billion respectively, spread over the time of building. Although 2022 could see some delays due to material shortages and inflation, and the consequences of the war in Ukraine, among other volatile indicators, the will and demand are real.

Looking at their nature, the new announcements are being noticeably driven towards solutions that address the climate change crisis. Indeed, since 2020, during and after the release of the Green Deal and the Covid crisis, at least part of all newly reported activities are an answer to the disruptions we are currently going through.

Carbon Capture and Usages (CCU) installations, liquid CO2 export terminal, recycling plants, EV battery production units, hydrogen ecosystems, and even a plant for manufacturing flying boats appeared in the investment tracking tools.

55 hydrogen production plants will pop up across Europe with, at the head of the pack, the Netherlands aiming to build 13 units, followed by France with 8, the UK with 7 and Germany with 6 units. A remarkable 71% of this portfolio has been announced since 2020 only!

Battery production is booming too, aiming to respond to increasing demand for lithium batteries and fuel cells. 26 out of 42 active projects were recently announced. 5 out of these 26 are already under construction. Engagement in this area is vivid all across the EU, as Hungary is set to host 8 plants. 6 production plants including gigafactories will be constructed in France. Germany and Sweden will go with 5 each. The UK will get three units. Italy, Poland and Romania will add another two each. A gigafactory dedicated exclusively to fuel cell production will break ground in Norway. As per today, 15 of the battery production plants are set to enter into the building phase in 2022, with another 12 set to follow in 2023. 11 plants are already under construction.

If we look at the energy sector, 577 new projects out of more than 1500, accounting for USD 258 billion, have been added onto the tracking records since 2020. 327 of the overall portfolio are already being built. These include projects in wind, solar, biomass, biofuel, ammonium plants, hydroelectric, geothermal, waste to energy, and so on. Wind and solar numbers are imposing as expected. Around 1200 projects are active. About 460 wind and/or solar farms are set to start construction in 2022 and 320 in 2023, for around USD 300 billion.

The Circular Economy is not lagging behind. 13 out of 27 recycling listed plants have been announced since 2020, dealing with chemical waste, rare earth, lithium and nickel batteries, plastic, scrap or tyres, etc., and are totally or partially funded by USD 1.7 billion. 15 out of the 27 tracked plants would start construction in 2022 and seven in 2023. And this doesn’t count the waste-to-energy and the nuclear units documented under the energy area.

The TEN-T (Trans-European Transport Network), as it relates to the Green Deal, also has investment potential. For example, the rail ecosystem is showing big figures. 76 projects have been announced since 2020, for a total amount of USD 31.3 billion. These include projects on conventional railways, freight railways, high-speed and mass rapid transit all around Europe. 126 projects in road infrastructure and bridges have been newly registered on the records too, for a total investment of USD 35.5 billion. If we look at the overall portfolio, 319 projects (44% of the total) are supposedly starting construction in 2022 and 2023 in the rail ecosystem and 493 (40.6%) in road infrastructures all across the Continent.

With respect to the pharmaceutical and agri-food sectors, 49 out of 93 pharmaceutical complexes have been announced lately, totaling USD 7.9 billion. 72 out of 328 active projects have been reported since 2020, related to the agro industry for a total investment of USD 8.4 billion.

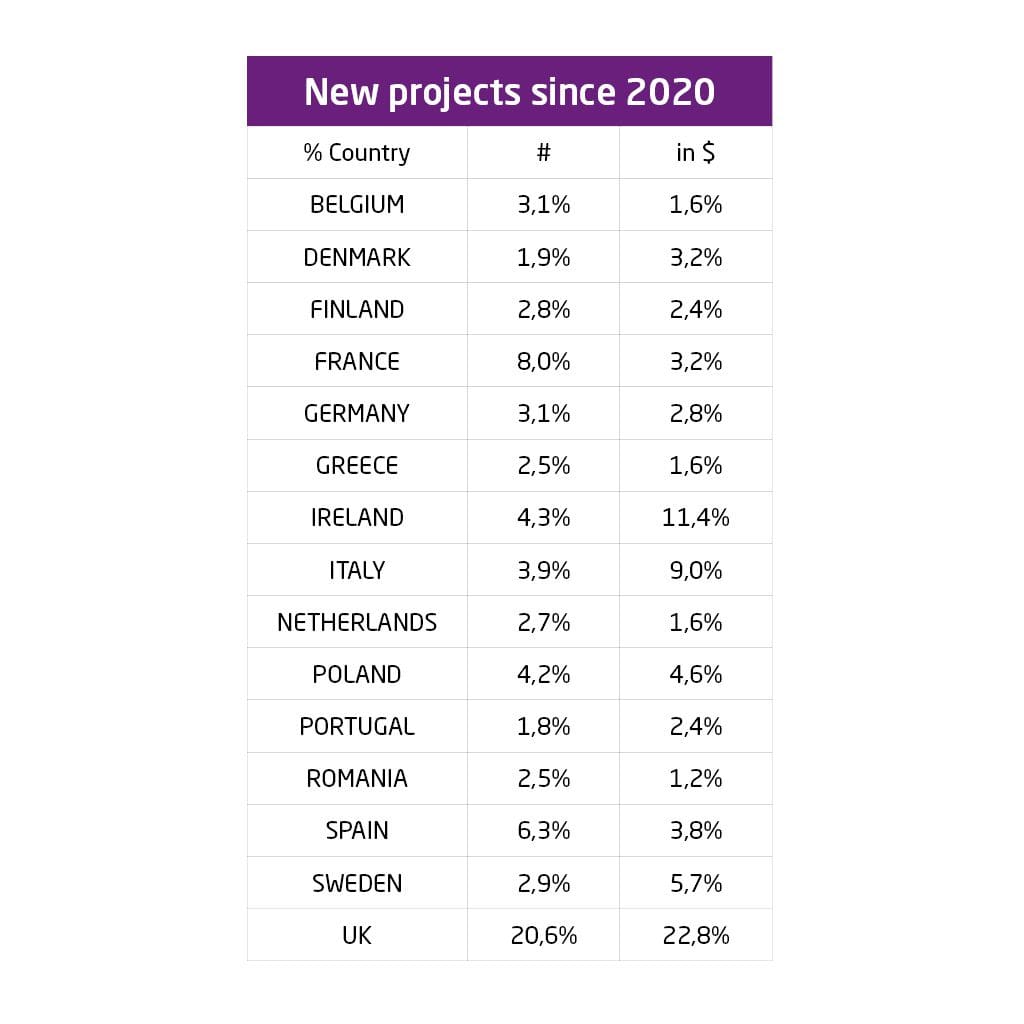

From a territorial point of view, the industrial projects announced since 2020 in the energy, industrial and infrastructural investment portfolio are not equitably spread across the EU. 22.8% of total project value are supported by the UK, followed by Ireland (11.4%), Italy (9.0%), and Sweden (5.7%). Here again, the rail, energy, road and the agro ecosystems are at stake.

Considering the picture in numbers, the UK gets a 20.6% share, accounting for 294 projects, France (114), Spain (90), Ireland (61) and Italy (56). Germany is accounting for around 3% of all new constructions, in units and in value, for now.

To conclude, mapping these perspectives allows us to understand how the industry has seriously moved at the speed of light, when considering industrial time, towards new sustainable businesses, and how countries are progressing and positioning themselves domestically. Industry is concretely ahead and at all fronts when it comes to creating a sustainable future.

The breakthroughs are indeed inspiring and will have long lasting footprints. As evolutive as science and technology can be, the word ‘Innovation’ is really meaningful and prospects are high. No doubt that other construction intentions will come along, and even more when all Green Deal initiatives will completely be carved into stone.

We, at Aperam, are looking towards clever businesses and will be following all further evolution of these portfolios. Stay tuned!

Data source: Globaldata – MI Analysis

-2,63%

-2,63%