From Risk to Resilience: How Industry Can Secure part of its Critical Raw Materials’ needs

As the world enters an era of climate change resolution, renovations and large-scale technological renewal, the Stone and the Iron Age are not over yet. Minerals and metals are, indeed, key components of new sustainable technologies, used for their unique properties. The supply of critical and strategic raw materials is therefore under pressure, with growing risks of disruption.

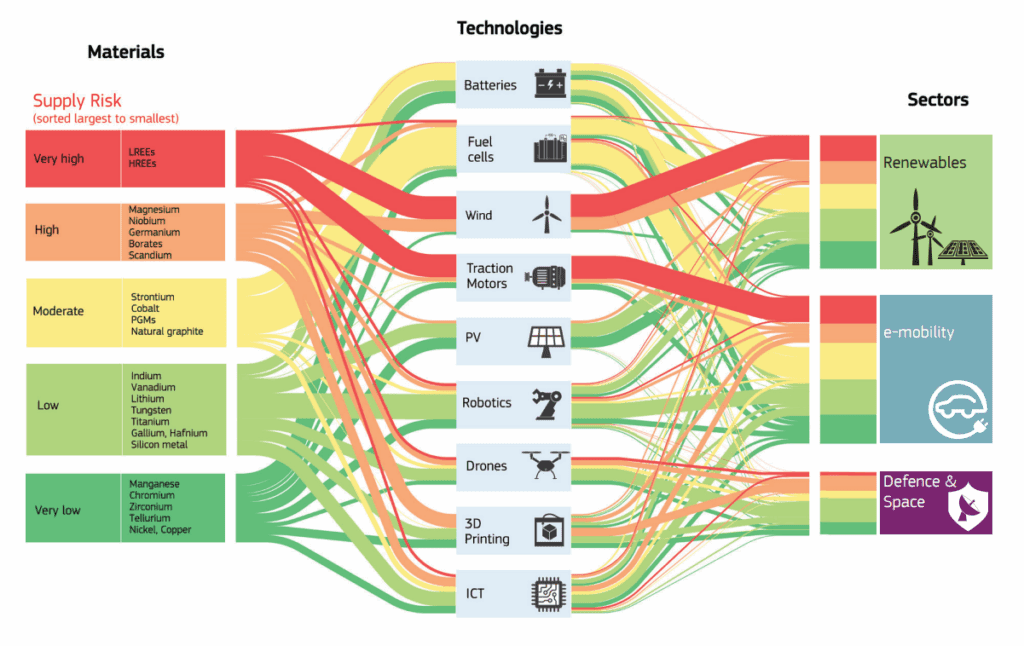

These materials are essential in sectors such as electric mobility (lithium, cobalt, nickel, rare earths), fuel cells (platinum group metals), offshore wind (nickel, copper, rare earths), aeronautics (titanium), photovoltaics (copper, silicon), and defence (tungsten: 12% of global demand), to name only a few.

The International Energy Agency (IEA) forecasts a tenfold increase in lithium demand, a threefold in cobalt and a twofold in copper by 2050.

According to CEPII, meeting the Paris Agreement objectives would lead to a fourfold increase in global mineral consumption.

Availability and Accessibility

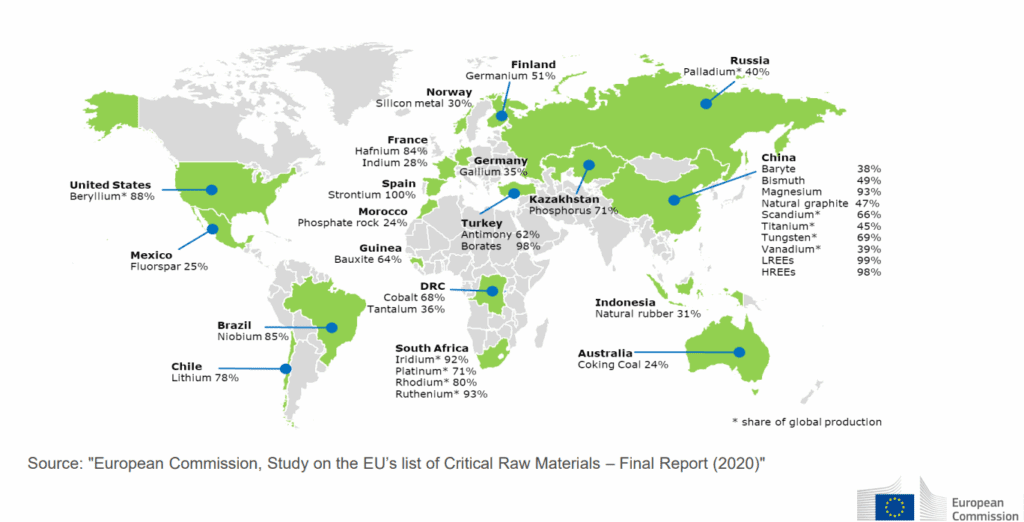

The European Union has identified a key structural issue: the global supply of critical raw materials is highly concentrated.

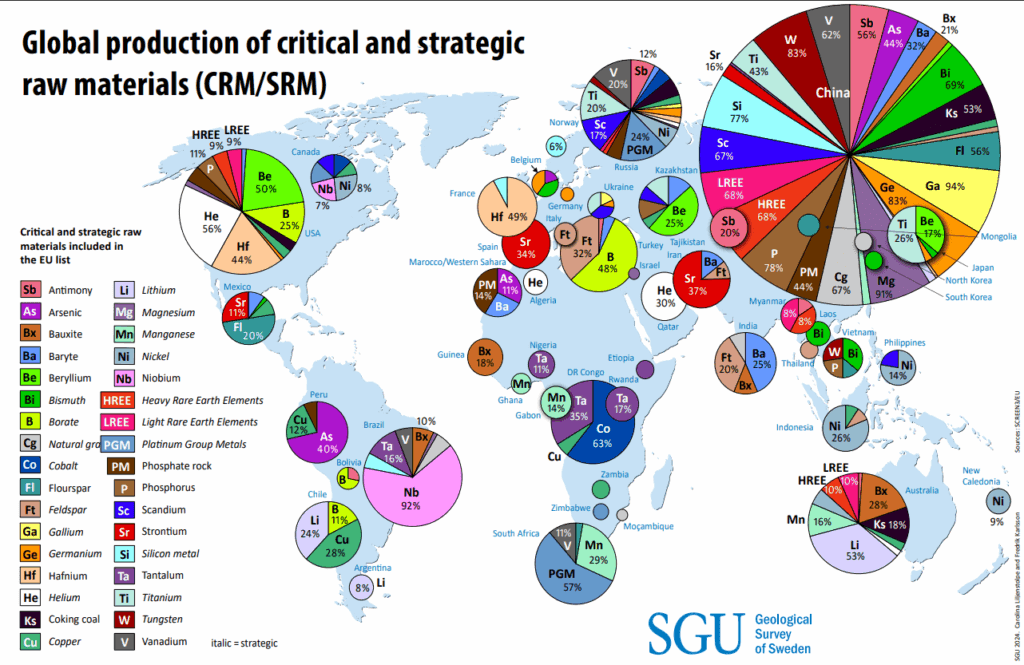

As of 2023, Asia accounted for 62.3% of total global mineral and metal production from mining, while North America represented slightly over 15%.

China stands out as the dominant player. For decades, the country has built a model of self-sufficiency, anticipating industrial needs and implementing adaptive policies through taxation and export controls. These measures apply across production, refining, distribution and stockpiling of a wide range of metals.

In 2022, China alone accounted for 90% of global rare earths output and 74% of cobalt. Overall, it controls between 60% and 90% of the metals essential to low-carbon technologies, reshaping the global market dynamics.

According to the European Commission, China supplies 100% of the EU’s imports of heavy rare earth elements (HREE). Turkey covers 99% of the EU’s boron needs, while South Africa provides 71% of its platinum and even higher proportions of iridium, rhodium and ruthenium.

In this context, securing long-term access to strategic raw materials is no longer solely a matter of business—it is a matter of geopolitics. These resources have become strategic levers used to influence international negotiations.

Reuters reported in March 2025 that antimony—used in semiconductors, flame retardants, solar power equipment and munitions—had not been exported to the EU since October 2024. The restriction follows export controls imposed by China, which accounts for nearly half of global production, leading to sharp rises in prices.

The United States, itself, is accelerating investment in its own critical mineral capacities and drastically seeking to secure access to European mining resources.

While high-level negotiations continue, economies must navigate persistent and growing uncertainty on a daily basis.

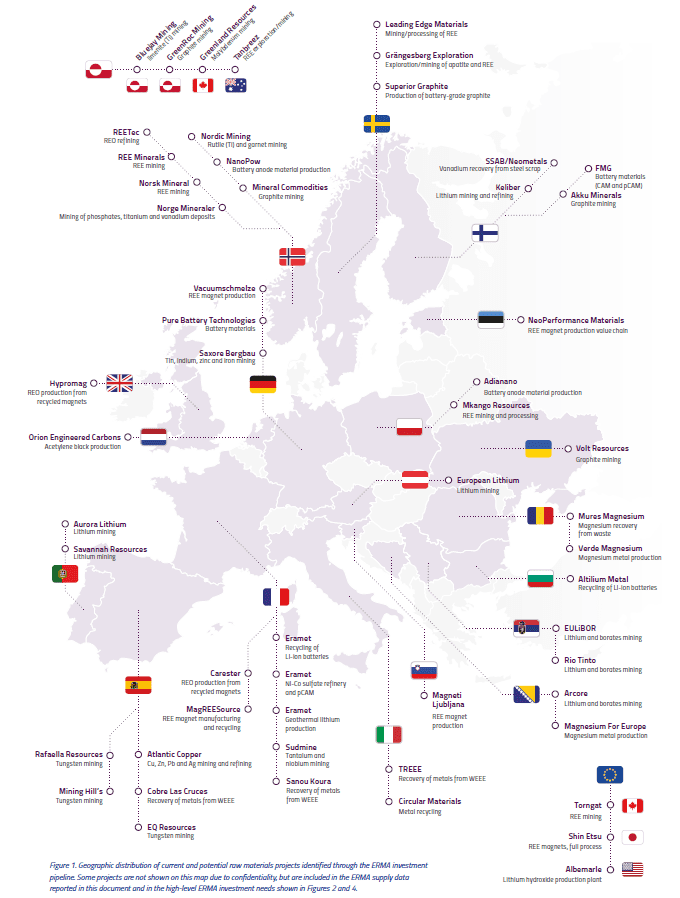

In response, the EU is reinforcing its sovereignty and strategic autonomy through new regulations, notably the Critical Raw Materials (CRM) Act launched in 2024. The Act aims to:

- Establish a list of strategic and Critical Raw Material (CRM). 16 strategic and 34 critical raw materials have been flagged;

- Map mining assets within the EU;

- Co-invest in sustainable mining and refining projects;

- Include critical materials in a coordinated public-private stockpiling strategy;

- Strengthen international partnerships for supply visibility and access;

- Promote circularity, including urban mining.

Not all countries possess exploitable critical raw material reserves. Moreover, mining projects often face public opposition due to environmental and historical concerns. Community acceptance remains a vivid issue, and permitting procedures are typically lengthy.

While awaiting results from new investments and partnerships, the most immediate solutions available to the EU are improving the existing, building strategic stockpiling in a timely manner and strengthening the recycling sector.

Industrial Considerations

Since the Covid-19 pandemic, the global industrial sector has faced recurring supply chain disruptions. Volatility and uncertainty now define the operational landscape.

The Industry as a whole, has an indirect hand to play in this geopolitical “fait accompli” by strengthening qualitative ties with its international business partners and assets that can weigh at best, on the overall pattern for an appeased world.

High-level dialogues addressing hurdles and adaptive solutions through federations can really be effective to pursue efficiency. But at a macro level, this is it.

Beyond diplomacy, one of the most concrete measures industry can take is to stockpile critical materials within EU member states, in alignment with the CRM Act. This would help mitigate potential shocks from a significant decline in the global trade-to-GDP ratio, which currently stands at around 60%.

Strategic pooling of raw materials will enhance scalability and cost-efficiency, while protecting against supply shortages.

Furthermore, according to the European Commission, risks are exacerbated by low substitution and recycling rates.

Indeed, the true weight of industry also lies in the choices it makes to manage its operations. Ultimately, it lies in the choice of materials used in product design, seeking, at a minimum, available, safe, long lasting and recyclable high-performance materials.

Minerals and metals are essential for their unique functional properties. These cannot be compromised when alloyed. Demand is moreover set to rise sharply, as said.

Key factors such as urban mining, recycling rates, product long life cycle, reduced maintenance for high-performance materials, all are fundamental criteria for a reasoned material management that fall partially or entirely within the scope of industrial engineering and sourcing.

Material knowledge, selection and design are becoming core to strategic planning. Making the right choices at the micro and macro levels—short and long-term—is essential to secure sustainable access and industrial competitiveness. These are areas where the industry has a full ESG role to play.

We, at Aperam, are committed to engaging with any stakeholder to share on material and strategic resilience, in order to better and together make our sincere contribution to sustainability.

Sources:

- Les 10 points sur les métaux stratégiques, Le Grand Continent, 2023

- Rare Earth price at July 25

- A comprehensive review of urban mining and the value recovery from e-waste materials, Lúcia Helena Xavier, Marianna Ottoni, Leonardo Picanço Peixoto Abreu, Resources, Conservation and Recycling, Elsevier, 2023

- Materials for Energy Storage and Conversion A European Call for Action, The Raw Material Alliance, 2023

- Matières premières critiques : vers l’autonomie stratégique européenne ?, Romain Capliez, Carl Grekou, Emmanuel Hache, Valérie Mignon, CEPII, 2025

- Trade Dependencies: While China Is in a Dominant Position, the European Union Is Not Without Advantages, Pauline Wibaux, CEPII

- China export controls freeze antimony shipments to EU from October

- Critical Raw Material global mapping

- Critical and strategic raw materials, EU Commission

- Study on the Critical Raw Materials for the EU 2023 – Final Report – European Commission

- Législation de l’UE sur les matières premières critiques pour l’avenir des chaînes d’approvisionnement de l’UE, EU Commission

- Résilience des matières premières critiques: la voie à suivre pour un renforcement de la sécurité et de la durabilité, EU Commission

- Raw Materials Roadmap, EU Commission

- EU stockpiling strategy: Boosting the EU’s material preparedness for crises, EU Commission

- Share of top three producing countries in processing of selected minerals, IEA, 2022

- Minerals with Net Import Reliance on China, US Government

- Trump Administration Advances First Wave of Critical Mineral Production Projects, Permitting US Government

Tools:

-2,40%

-2,40%